Accounts from Incomplete Records - TN State Board 12th Accountancy Book Back Solution Guide

Chapter 1 Accounts from incomplete records

I. Choose the correct answer

1. Incomplete records are generally

maintained by

(a)

A company (b) Government

(c)

Small sized sole trader business (d) Multinational enterprises

Answer: (c) Small Sized sole trader business

2. Statement of affairs is a

(a)

Statement of income and expenditure (b) Statement of assets and liabilities

(c)

Summary of cash transactions (d) Summary of credit transactions

Answer: (b) Statement of assets and liabilities

(a) Capital in the beginning of

the year (b) Capital at the end of the year

(c)

Profit made during the year (d) Loss occurred during the year

Answer: (a) Capital in the beginning of the year

4. The excess of assets over liabilities is

(a)

Loss (b) Cash (c) Capital (d) Profit

Answer: (c) Capital

5. Which of the following items relating to bills payable is transferred to total creditors account?

(a)

Opening balance of bills payable (b) Closing balance of bills payable

(c) Bills

payable accepted during the year (d) Cash paid for bills payable

Answer: (c) Bills payable accepted during the year

6. The amount of credit sales can be

computed from

(a)

Total debtors account (b) Total creditors account

(c)

Bills receivable account (d) Bills payable account

Answer: (a) Total debtors account

7. Which one of the following statements is not true in relation to incomplete records?

(b) Records are maintained only for

cash and personal accounts

(c) It is suitable for all types

of organisations

(d) Tax authorities do not accept

Answer: (c) It is suitable for all types of

organisations

8. What is the amount of capital of

the proprietor, if his assets are ₹85,000 and liabilities are ₹21,000?

(a)

₹ 85,000

(b) ₹ 1,06,000

(c) ₹ 21,000

(d) ₹ 64,000

Answer: (d) ₹64,000

9. When capital in the beginning is ₹10,000, drawings during the year are ₹6,000, profit made during the year is ₹2,000 and the additional capital introduced is ₹3,000, find out the amount of capital at the end.

(a)

₹ 9,000

(b) ₹ 11,000

(c) ₹ 21,000

(d) ₹ 3,000

Answer: (a) ₹9,000

10. Opening balance of debtors: ₹ 30,000,

cash received: ₹

1,00,000, credit sales: ₹ 90,000; closing balance of debtors is

(a)

₹ 30,000

b) ₹ 1,30,000

c) ₹ 40,000

d) ₹ 20,000

Answer: (d) ₹20,000

II Very short answer questions

12th Standard Chapter 1 Question No.1

What is meant by incomplete records?

Answer:

When

accounting records are not strictly maintained according to double entry

system, these records are called incomplete accounting records.

Generally, cash account and the personal accounts of customers and creditors are maintained fully and other accounts are maintained based on necessity.

12th Standard Chapter 1 Question No.2

State

the accounts generally maintained by small sized sole trader when double entry

accounting system is not followed.

Answer:

Only cash account and personal

accounts are maintained by small sized sole trader when double entry accounting

system is not followed.

12th Standard Chapter 1 Question No.3

What is a statement of affairs?

Answer:

A statement of affairs is a statement showing the balances of assets and liabilities on a particular date. The balances of assets are shown on the right side and the balances of liabilities on the left side. This statement resembles a balance sheet. The difference between the total of assets and total of liabilities is taken as capital.

Capital = Assets – Liabilities

III

Short answer questions

12th Standard Chapter 1 Short Answer Question No.1

What are the features of incomplete records?

Answer:

Following are the features of

incomplete records:

(i) Nature: It is an

unscientific and unsystematic way of recording transactions. Accounting

principles and accounting standards are not followed properly.

(ii) Type of accounts

maintained: In general, only cash and personal accounts are maintained

fully. Real accounts and nominal accounts are not maintained properly. Some

transactions are completely omitted.

(iii)

Lack of uniformity: There is no uniformity in recording the transactions

among different organisations. Different organisations record their

transactions according to their needs and conveniences.

(iv)

Financial

statements may not represent true and fair view: Due to the incomplete

information and inaccurate records of accounts, the profit or loss calculated

from these records cannot be relied upon. It may not represent true

profitability. Assets and liabilities may not represent a true and fair view of

financial position.

(v) Suitability: Only the

business concerns which have no legal obligation to maintain books of accounts

under double entry system may maintain incomplete records. Hence, it may be

maintained by small sized sole traders and partnership firms.

(vi) Mixing up of personal and business transactions: Generally, personal transactions of the owners are mixed up with the business transactions. For example, purchase of goods for own use may be mixed up along with business purchases.

12th Standard Chapter 1 Short Answer Question No.2

What are the limitations of incomplete records?

Answer:

Following are the limitations of incomplete records:

(i) Lack of proper maintenance

of records: It is an unscientific and unsystematic way of maintaining

records. Real and nominal accounts are not maintained properly.

(ii) Difficulty in preparing

trial balance: As accounts are not maintained for all items, the accounting

records are incomplete. Hence, it is difficult to prepare trial balance to

check the arithmetical accuracy of the accounts.

(iii) Difficulty in

ascertaining true profitability of the business: Profit is found out based

on available information and estimates. Hence, it is difficult to ascertain

true profit as the trading and profit and loss account cannot be prepared with

accuracy.

(iv) Difficulty in

ascertaining financial position: In general, only the estimated values of

assets and liabilities are available from incomplete records. Hence, it is

difficult to ascertain true and fair view of state of affairs or financial

position as on a particular date.

(v) Errors and frauds cannot

be detected easily: As only partial records are available, it may not be

possible to have internal checks in maintaining accounts to detect errors and

frauds.

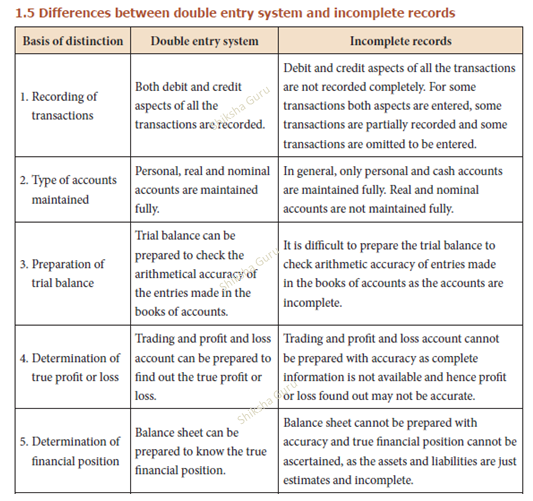

State the differences between double entry system and incomplete records.

Answer:

12th Standard Chapter 1 Short Answer Question No.4

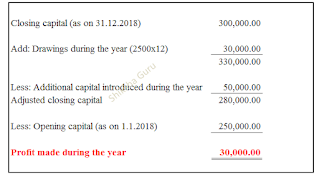

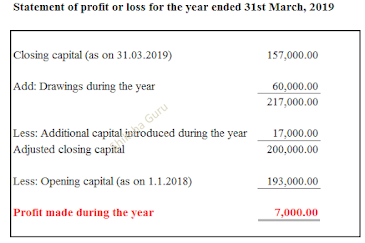

State the procedure for calculating profit or loss through statement of affairs.

Answer:

The

difference between the closing capital and the opening capital is taken as

profit or loss of the business. Due adjustments are to be made for any

withdrawal of capital from the business and for the additional capital

introduced in the business.

Adjusted closing capital = Closing capital + Drawings – Additional capital

Closing Capital + Drawings – Additional Capital – Opening Capital = Profit/ Loss

12th Standard Chapter 1 Short Answer Question No.5

Differentiate between statement of affairs and balance sheet.

Answer:

Answer:

12th Standard Chapter 1 Exercise No.9

Comments

Post a Comment