Goodwill in Partnership Accounts - TN State Board 12th Accountancy Book Back Solution Guide

Chapter 4 Goodwill in Partnership Accounts

I. Choose the correct answer

1. Which of the following statements

is true?

(a) Goodwill is an intangible

asset (b) Goodwill is a current asset

(c)

Goodwill is a fictitious asset (d) Goodwill cannot be acquired

Answer:

(a) Goodwill is an intangible asset

2. Super profit is

the difference between

(a) Capital

employed and average profit (b) Assets and liabilities

(c) Average

profit and normal profit (d) Current year’s profit and average profit

Answer:

(c) Average profit and normal profit

3. The average rate

of return of similar concerns is considered as

(a) Average

profit (b) Normal rate of return

(c) Expected

rate of return (d) None of these

Answer:

(b) Normal rate of return

4. Which of the

following is true?

(a)

Super profit = Total profit / number of years

(b)

Super profit = Weighted profit / number of years

(c)

Super profit = Average profit – Normal profit

(d) Super profit = Average profit

× Years of purchase

5. Identify the

incorrect pair

(a)

Goodwill under Average profit method - Average profit × Number of years of

purchase

(b)

Goodwill under Super profit method - Super profit × Number of years of purchase

(c)

Goodwill under Annuity method - Average profit × Present value annuity factor

(d) Goodwill under Weighted

average - Weighted average profit × Number of years of profit method purchase

6. When the average

profit is ₹ 25,000 and the normal profit is ₹ 15,000, super profit is

(a) ₹ 25,000

(b) ₹ 5,000 (c) ₹ 10,000 (d) ₹ 15,000

7. Book profit of

2017 is ₹ 35,000; non-recurring income included in the profit is ₹ 1,000 and

abnormal loss charged in the year 2017 was ₹ 2,000, then the adjusted profit is

(a) ₹ 36,000 (b)

₹ 35,000

(c) ₹ 38,000 (d)

₹ 34,000

Answer:

(a) ₹ 36,000

8. The total

capitalised value of a business is ₹ 1,00,000; assets are ₹ 1,50,000 and

liabilities are ₹ 80,000. The value of goodwill as per the capitalisation

method will be

(a) ₹ 40,000 (b) ₹ 70,000

(c) ₹ 1,00,000 (d) ₹ 30,000

Answer:

(d) ₹ 30,000

II Very short answer questions

12th Standard Chapter 4 Question No.1

What

is goodwill?

Answer:

Goodwill

is the good name or reputation of the business which brings benefit to the

business. It enables the business to earn more profit. It is the present value

of a firm’s future excess earnings. It is an intangible asset as it has no

physical existence.

12th Standard Chapter 4 Question No.2

What

is acquired goodwill?

Answer:

Goodwill

acquired by making payment in cash or kind is called acquired or purchased

goodwill. When a firm purchases an existing business, the price paid for

purchase of such business may exceed the net assets (Assets – Liabilities) of

the business acquired. The excess of purchase consideration over the value of

net assets acquired is treated as acquired goodwill.

12th Standard Chapter 4 Question No.3

What

is super profit?

Answer:

Super profit is the base for calculation of the value of goodwill. Super profit is the excess of average

profit over the normal profit of a business.

Super profit = Average profit – Normal profit

What is normal rate of return?

Answer:

It is the rate

at which profit is earned by similar business entities in the industry under

normal circumstances.

State any two circumstances under which goodwill of

a partnership firm is valued.

Answer:

Following are the circumstances that require

valuation of goodwill of partnership firms in order to protect the rights of

the partners:

(i) When there is a change in the profit sharing ratio

(ii) When a new partner is admitted into

a firm

(iii) When an existing partner retires from the firm or when a partner dies

(iv) When a partnership firm is dissolved

III. Short answer questions

1. State any six factors determining

goodwill.

Answer:

- Profitability of the firm

- Favourable location of the business enterprise

- Good quality of goods or services offered

- Tenure of the business enterprise

- Efficiency of management

- Degree of competition

12th Standard Chapter 4 Short Answer Question No.2

How

is goodwill calculated under the super profits method?

Answer:

(i) Purchase of super profit method

Under this method, goodwill is

calculated by multiplying the super profit by a certain number of years of

purchase.

Goodwill = Super profit × Number of years of purchase

(ii) Annuity method

Under this method, value of

goodwill is calculated by multiplying the super profit with the present value

of annuity.

Goodwill

= Super profit × Present value annuity factor

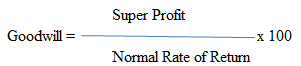

(iii) Capitalisation

of super profit method

Under this method, value of goodwill is calculated by capitalising the super profit at normal rate of return, that is, goodwill is the capitalised value of super profit.

12th Standard Chapter 4 Short Answer Question No.3

How

is the value of goodwill calculated under the capitalisation method?

Under this

method, goodwill is the excess of capitalised value of average profit of the

business over the actual capital employed in the business.

Goodwill = Total capitalised value of the business – Actual capital employed

The total capitalised value of the business is calculated by capitalising the average profits on the basis of the normal rate of return.

Actual capital employed = Fixed assets

(excluding goodwill) + Current assets – Current liabilities

Compute average profit from the following information:

Goodwill = Average Profit x Number of years of Purchase

IV. Exercises

Answer:

Answer:

12th Standard Chapter 4 Exercise No.3

Answer:

12th Standard Chapter 4 Exercise No.4

Answer:

Answer:

Answer:

Comments

Post a Comment